China’s truck and construction machinery industries pose certain challenges to European and American brands.

In recent years, with the development of Chinese brand trucks and construction machinery, they have posed certain challenges to some traditional European and American brands such as Caterpillar.

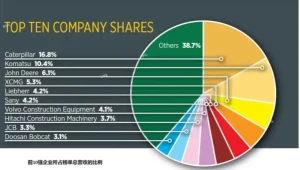

In the field of construction machinery, in the first half of 2024, China’s domestic market demand improved significantly, while overseas markets also maintained growth. Chinese brand excavators account for 86.8% of the domestic market, while European and American brands only account for 6.4%, and Japanese and Korean brands account for 6.8%. This shows that Chinese brands have made breakthroughs in mainframe core technology and significantly improved their market competitiveness. Although there is still a certain gap in product technology level with internationally renowned brands, Chinese brands have been highly recognized by domestic customers in terms of technological progress and service guarantee capabilities. Among them, the outstanding ones such as Xugong, Sany, Lonking, Liugong, and Lingong have all seen substantial growth in performance. Especially in overseas markets, such as XCMG (www.export-xcmg.com), the proportion of overseas revenue has exceeded 40%.

In the heavy truck industry, with the growth of China’s macro-economy, the rapid development of infrastructure construction and highway logistics and transportation industries has promoted the leapfrog growth of the heavy truck industry. China’s heavy-duty truck market has doubled in size over the past decade, but in the past two years, the market has suffered a cyclical decline due to economic fluctuations and the impact of the epidemic. Despite this, China’s heavy truck market still shows strong market concentration, with the market concentration of the top five companies exceeding 80%. China’s heavy truck industry is facing various structural opportunities brought about by new trends such as product structure upgrades and the new four modernizations. In overseas markets, Sinotruk is the leader of domestic brands. Its exports firmly occupy the first place among domestic trucks, accounting for 50% of the overseas market share.

In the field of commercial vehicles, Chinese brand trucks will completely dominate sales in 2023, and the top ten are all domestic brands. The price of Chinese heavy-duty trucks is lower than that of European and American brands, but they are cost-effective and meet the truck drivers’ needs for cost-effectiveness and durability. Chinese brands perform well in grasping user needs, while European and American brands focus more on comfort and design in the passenger car market.

Sinotruk Global Strategic Partner Conference

There is still a certain gap in technology and product between domestic trucks and European and American trucks. Domestic trucks have made significant progress in the past decade, such as improvements in cab space, comfort, power, etc., but they are relatively lagging behind in terms of core technology control capabilities. In contrast, European truck technology is mature and product iteration is slowing down. In recent years, as the parts supply systems of domestic trucks and European brands have gradually converged, the gap between the two sides has been rapidly shortening.

Enterprises such as China National Heavy Duty Truck have shown cost-effective advantages in competition with European and American brands. Through supply chain advantages, economies of scale and cost control, Sinotruk is able to provide cheaper products. Although there may be a gap in performance with European and American brands, it is highly competitive in the markets of developing and emerging economies.

The disadvantage is that Chinese brands are currently more focused on the sales of complete vehicles, and after-sales services and accessories are not yet complete, which brings certain challenges to their promotion. Many customers are therefore worried about the supply of after-sales and accessories. At present, these brands are also aware of this problem and are constantly deploying maintenance and parts outlets overseas. Some leading domestic exporters of heavy truck parts (www.sitrakgroup.com) are also constantly cooperating with powerful overseas merchants, which has also promoted the development to a certain extent. brand promotion.

In general, China’s truck and construction machinery industry is gradually narrowing the gap with European and American brands through technological progress and market strategies, and is showing competitive advantages in certain areas.